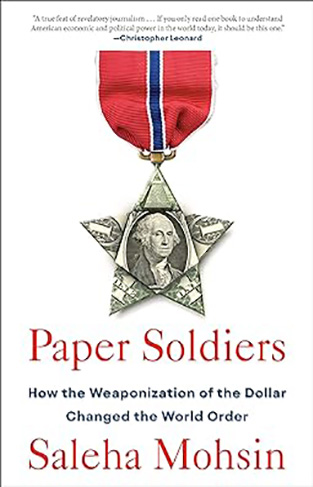

"Incisive debut treatise... Mohsin brings to the proceedings a reporter's eye for story" — Publisher's Weekly

From Bloomberg News reporter Saleha Mohsin, the untold story of how one of America’s most invincible institutions—the Treasury—has used the U.S. dollar to define America’s role in the world, and our economic future.

In 1995, Treasury Secretary Robert Rubin re-defined the next thirty years of currency policy with the mantra, “A strong dollar is in America’s interest.” That mantra held, ushering in exceptional prosperity and cheap foreign goods, but the strong dollar policy also played a role in the devastating hollowing out of America’s manufacturing sector. Meanwhile, abroad, the United States increasingly turned to the dollar as a weapon of war. In Paper Soldiers, Saleha Mohsin reveals how the Treasury Department has shaped U.S. policy at home and overseas by wielding the American dollar as a weapon—and what that means in a new age of crisis.

For decades, America has preferred its currency superpower-strong, the basis of a "strong dollar" policy that attracted foreign investors and pleased consumers. Drawing on Mohsin's unparalleled access to current and former Treasury officials like Robert Rubin, Steven Mnuchin, and Janet Yellen, Paper Soldiers traces that policy's intended and unintended consequences, including the rise of populist sentiment and trade war with China—culminating in an unprecedented attack on the dollar’s pristine status during the Trump presidency—and connects the dollar's weaponization from 9/11 to the deployment of crippling financial sanctions against Russia. Ultimately, Mohsin argues that, untethered from many of the economic assumptions of the last generation, the power and influence of the American dollar is now at stake.